The post-election rally fizzled this week. Major US stock indices are lower as markets refocus on inflation and interest rates.

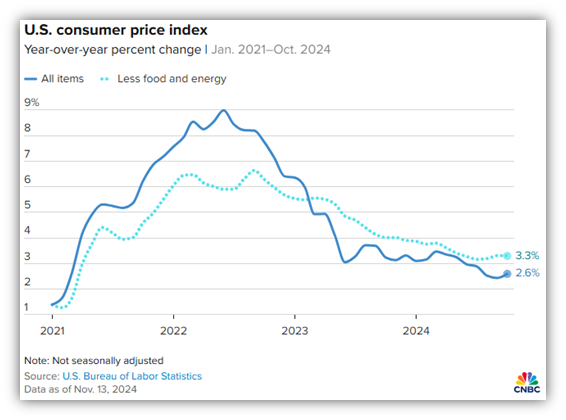

Prices were up in October in line with expectations, pushing the annual inflation rate up to 2.6% from 2.4% in September. Core inflation (minus food and energy) rose to 3.3% as expected.

Markets are also considering the potential impacts of certain policies promoted by President Trump during his campaign, namely tariffs. While a potential benefit of tariffs could include making US companies more competitive domestically in certain industries, the downside would be higher prices paid by American consumers, translating to higher inflation next year. And higher inflation almost certainly means higher interest rates.

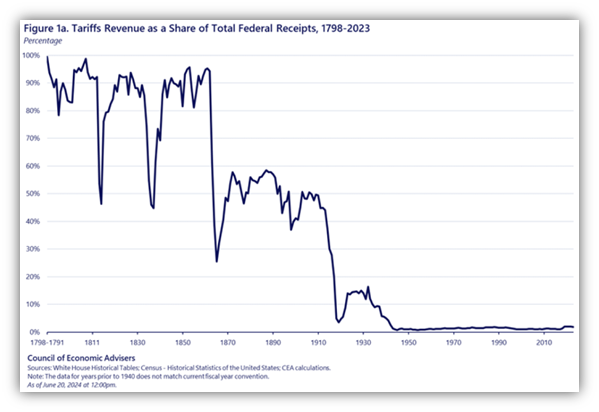

Tariffs were a meaningful part of how our government raised revenue prior to the establishment if the income tax.

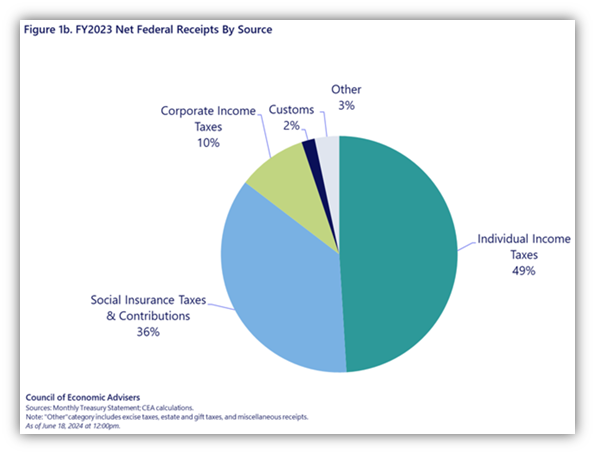

Currently, tariffs make up just 2% of federal revenues.

Other policies, including eliminating taxes on tips, overtime, and Social Security, could also be inflationary (at least temporarily) as many consumers would suddenly have additional income to spend. But the larger problem with these policies would be the reduction in federal tax revenue if they aren’t offset by massive spending cuts or additional taxes elsewhere.

Markets have been celebrating the potential for less government regulation and increased government efficiency under the coming Trump administration, but uncertainty surrounding inflation in 2025 is creeping into the markets and beginning to dampen enthusiasm.

Have a great weekend.

Jack C. Harmon II, CFP®, CIMA

Principal, Harmon Financial Advisors

Registered Principal, Raymond James Financial Services

Harmon Financial Advisors, Inc. is an independent, fee-based financial planning firm and an independent Registered Investment Advisor. Investment advisory services offered through Raymond James Financial Services Advisors, Inc. and Harmon Financial Advisors, Inc. Securities offered through Raymond James Financial Services, Inc. Member FINRA/SIPC. Harmon Financial Advisors, Inc. is not a registered broker/dealer and is independent of Raymond James Financial Services, Inc.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information in this commercial email has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Any opinions are those of Harmon Financial Advisors, Inc. and not necessarily those of RJFS or Raymond James.

Investing involves risk and you may incur a profit or loss regardless of strategy selected.

Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, and CFP® in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

Investments & Wealth Institute™ (The Institute) is the owner of the certification marks “CIMA” and “Certified Investment Management Analyst.” Use of CIMA and/or Certified Investment Management Analyst signifies that the user has successfully completed The Institute’s initial and ongoing credentialing requirements for investment management professionals.

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market.