A combination of more pro-growth policy announcements from the Trump administration and good 4th quarter corporate earnings reports pushed stocks higher this week. One announcement generating a lot of buzz in the markets this week was for Project Stargate –

“The Stargate Project is a new company which intends to invest $500 billion over the next four years building new AI infrastructure for OpenAI in the United States. We will begin deploying $100 billion immediately. This infrastructure will secure American leadership in AI, create hundreds of thousands of American jobs, and generate massive economic benefit for the entire world. This project will not only support the re-industrialization of the United States but also provide a strategic capability to protect the national security of America and its allies.”

https://openai.com/index/announcing-the-stargate-project/

President Trump made other announcements this week committing to make the United States the “world capital” of artificial intelligence (AI) and digital currency (crypto), further tickling the ears of US tech investors.

Markets are also carefully watching for the potential impact of tariffs threatened by President Trump. Given the current weakness of other major economies, Trump sees an opportunity for the US to negotiate from a unique position of strength, to extract various beneficial terms from Europe, China, Mexico, and Canada specifically.

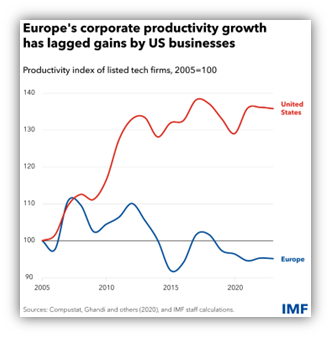

Europe is struggling on several fronts that are likely to require fundamental reform. And this time it’s not a smaller economy like Greece raising concerns, but the region’s two largest economies of France and Germany. They can ill-afford a trade war with the US, the largest market for EU exports. Trump is counting on it.

The Chinese economy is struggling to rebound from recession, but still has problems with youth unemployment (17.1% for 16-24 year-olds), decreasing foreign investment, a real estate crisis, and bad bank loans. Trump is hoping the Chinese will opt for concessions as an alternative to another economic headwind to deal with.

https://www.bbc.com/news/articles/ceq9lxlg811o

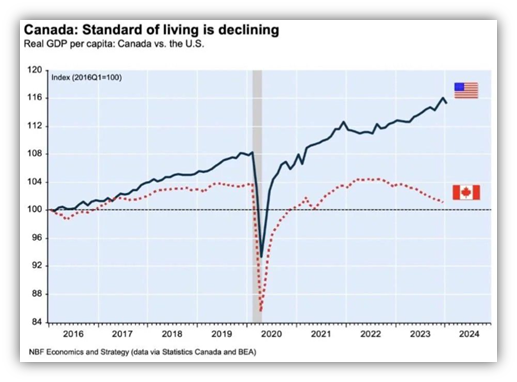

And in Canada, the threat of tariffs was enough to topple an already unpopular leader in, possibly clearing the way for a government easier for the Trump administration to work with.

“Trudeau’s handling of Trump precipitated the final blow to his tenure, with the high-profile departure last month of his Deputy Prime Minister and Finance Minister Chrystia Freeland. In a scathing resignation letter, she accused Trudeau of failing to take seriously Trump’s threats to increase import tariffs on Canadian goods. Freeland warned that Canada needed to take Trump’s plans “extremely seriously” and avoid “costly political gimmicks.”

This is why the markets aren’t panicking over tariffs. Currently, they’re cautiously confident that more good than bad will come of this strategy.

Have a great weekend.

Jack C. Harmon II, CFP®, CIMA

Principal, Harmon Financial Advisors

Registered Principal, Raymond James Financial Services

Harmon Financial Advisors, Inc. is an independent, fee-based financial planning firm and an independent Registered Investment Advisor. Investment advisory services offered through Raymond James Financial Services Advisors, Inc. and Harmon Financial Advisors, Inc. Securities offered through Raymond James Financial Services, Inc. Member FINRA/SIPC. Harmon Financial Advisors, Inc. is not a registered broker/dealer and is independent of Raymond James Financial Services, Inc.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information in this commercial email has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Any opinions are those of Harmon Financial Advisors, Inc. and not necessarily those of RJFS or Raymond James.

Investing involves risk and you may incur a profit or loss regardless of strategy selected.

The Dow Jones Industrial Average (DJIA), commonly known as “The Dow” is an index representing 30 stocks of companies maintained and reviewed by the editors of the Wall Street Journal.

Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, and CFP® in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

Investments & Wealth Institute™ (The Institute) is the owner of the certification marks “CIMA” and “Certified Investment Management Analyst.” Use of CIMA and/or Certified Investment Management Analyst signifies that the user has successfully completed The Institute’s initial and ongoing credentialing requirements for investment management professionals.