Major US stock indices are hanging in there in spite of an increasing number of risks for the markets to weigh. In addition to tariffs and an escalating war between Israel and Iran, US retail sales declined 0.9% in May, even more than the 0.6% drop expected from the Dow Jones consensus.

https://www.cnbc.com/2025/06/17/retail-sales-may-2025-.html

In light of all this uncertainty, the Fed decided this week to leave interest rates unchanged for now.

“So far, Trump’s tariffs have resulted in a surge of imports into the US, which has taken a toll on economic growth. However, inflation has been tame and the labor market remains in decent shape. Still, Fed officials don’t expect that to last: New economic projections show that officials expect unemployment to rise this year more than estimated in March — and for prices to pick up more than they previously thought.” – https://www.cnn.com/2025/06/18/economy/fed-rate-decision-june

I spent a couple of days this week in New York meeting with portfolio managers and research analysts at JPMorgan. While I was there, two of the most interesting discussions centered around international markets and US small company stocks.

Since the end of the Financial Crisis international stocks have badly underperformed US markets.

The primary driver of this US outperformance has been the make-up of the US economy vs international economies. The US economy is exemplified by its exceptionally profitable, innovative, and fast-growing firms in technology and communications. On the other hand, international markets remain dominated by traditional firms in banking, mining, and manufacturing. Additionally, the US economy and markets have benefited from much greater government borrowing and stimulus since 2010.

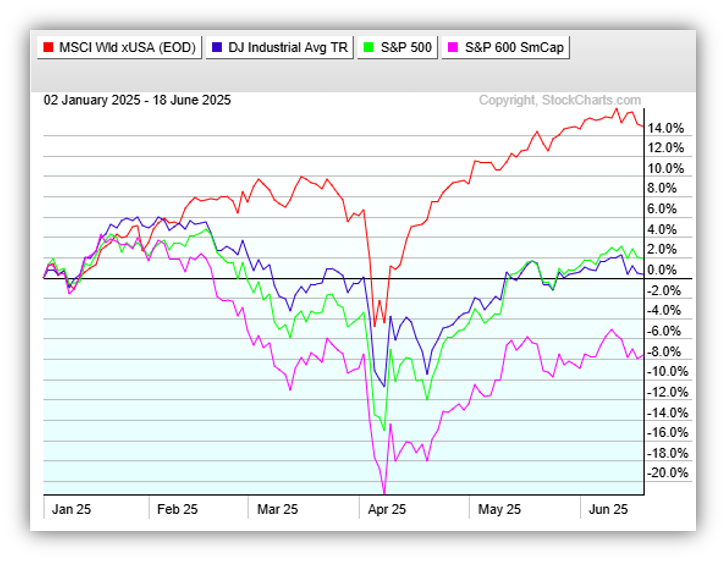

But this year things have changed as international stock indices are outperforming US markets by a wide margin. Red is international stocks, green and blue are large US companies, and pink is small US companies.

Analysts at JPMorgan believe this could continue for quite a while as foreign stocks have become much cheaper than US stocks. Additionally, US dollar weakness, increased European government spending, and better Japanese corporate governance are all tailwinds for international stocks.

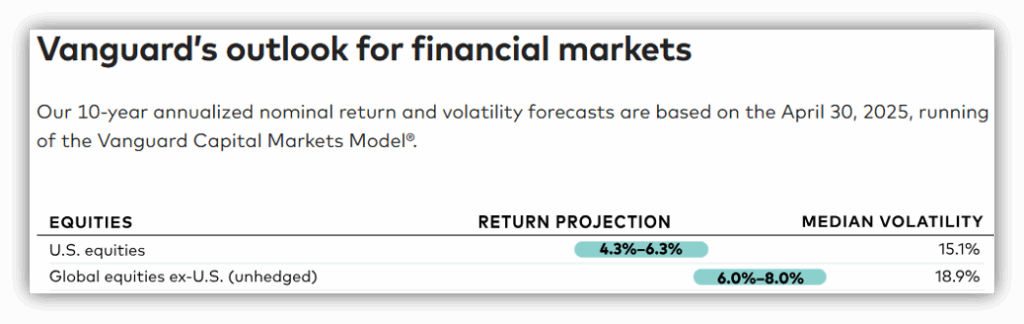

Many investment firms, including Vanguard, have been forecasting better returns for international stocks for a while now. As of April 30, they still believe international stocks will offer a better return for a little more volatility over the next decade.

https://advisors.vanguard.com/insights/article/series/market-perspectives

I’ll have to write about our US small stock discussion in a later email.

My wife Susan and I will be leaving Tuesday on a vacation trip to Alaska 6/24 – 7/5. While I will have my laptop and I will be keeping in touch with the office as I am able to, I don’t expect to send this weekly email for the next week or two.

Have a great weekend.

Jack C. Harmon II, CFP®, CIMA

Principal, Harmon Financial Advisors

Registered Principal, Raymond James Financial Services

Harmon Financial Advisors, Inc. is an independent, fee-based financial planning firm and an independent Registered Investment Advisor. Investment advisory services offered through Raymond James Financial Services Advisors, Inc. and Harmon Financial Advisors, Inc. Securities offered through Raymond James Financial Services, Inc. Member FINRA/SIPC. Harmon Financial Advisors, Inc. is not a registered broker/dealer and is independent of Raymond James Financial Services, Inc.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information in this commercial email has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Any opinions are those of Harmon Financial Advisors, Inc. and not necessarily those of RJFS or Raymond James.

There is no guarantee that these statements, opinions, or forecasts provided herein will prove to be correct. Past performance may not be indicative of future results.

Investing involves risk and you may incur a profit or loss regardless of strategy selected. International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility

The MSCI USA Index is designed to measure the performance of the large and mid-cap segments of the US market. With 576 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in the US.

The MSCI ACWI ex USA Index captures large and mid-cap representation across 22 of 23 Developed Markets (DM) countries (excluding the US) and 24 Emerging Markets (EM) countries. With 1,983 constituents, the index covers approximately 85% of the global equity opportunity set outside the US.

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market.

The Dow Jones Industrial Average (DJIA), commonly known as “The Dow” is an index representing 30 stocks of companies maintained and reviewed by the editors of the Wall Street Journal.

The MSCI World ex USA Index captures large and mid-cap companies across 22 of 23 Developed Markets (DM) countries excluding the United States. With 985 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

The S&P SmallCap 600 seeks to measure the small-cap segment of the U.S. equity market. The index is designed to track companies that meet specific inclusion criteria to ensure that they are liquid and financially viable.

Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor’s results will vary.

Bond prices and yields are subject to change based upon market conditions and availability. If bonds are sold prior to maturity, you may receive more or less than your initial investment. There is an inverse relationship between interest rate movements and fixed income prices. Generally, when interest rates rise, fixed income prices fall and when interest rates fall, fixed income prices rise.

Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

Investments & Wealth Institute™ (The Institute) is the owner of the certification marks “CIMA” and “Certified Investment Management Analyst.” Use of CIMA and/or Certified Investment Management Analyst signifies that the user has successfully completed The Institute’s initial and ongoing credentialing requirements for investment management professionals.