US stock indices finished the week at, or near, all-time highs, boosted by positive 2nd quarter earnings reports and good economic data. Initial jobless (unemployment) claims for the week ending July 12 decreased from the prior week, and June retail sales surpassed expectations.

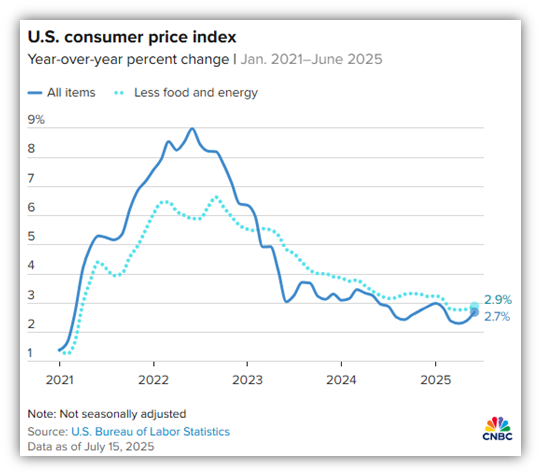

However, the most important economic report this week was the June inflation report. It showed the consumer price index (CPI) rose 0.3% in June, putting the 12-month inflation rate at 2.7%, which was in line with expectations. Core inflation (CPI minus food and energy) picked up 0.2% on the month, with the annual core inflation rate moving to 2.9%, in line with forecasts.

https://www.cnbc.com/2025/07/15/cpi-inflation-report-june-2025.html

President Trump pointed to the tame inflation report as a green light for the Fed to cut interest rates, but it’s hard to find any significant signs of weakness in the US economy that would cause them to cut rates in the midst of the current tariff uncertainty.

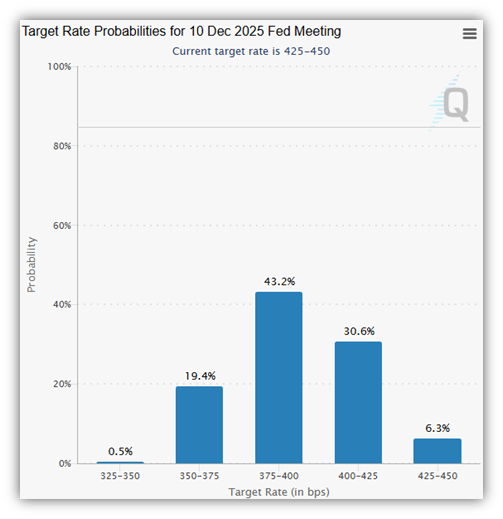

How many rate cuts will there be before year-end? Here are the odds according to the market:

No rate cuts = 6.3%

One rate cut = 30.6%

Two rate cuts = 43.2%

Three rate cuts = 19.4%

https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

Have a great weekend.

Jack C. Harmon II, CFP®, CIMA

Principal, Harmon Financial Advisors

Registered Principal, Raymond James Financial Services

Harmon Financial Advisors, Inc. is an independent, fee-based financial planning firm and an independent Registered Investment Advisor. Investment advisory services offered through Raymond James Financial Services Advisors, Inc. and Harmon Financial Advisors, Inc. Securities offered through Raymond James Financial Services, Inc. Member FINRA/SIPC. Harmon Financial Advisors, Inc. is not a registered broker/dealer and is independent of Raymond James Financial Services, Inc.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information in this commercial email has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Any opinions are those of Harmon Financial Advisors, Inc. and not necessarily those of RJFS or Raymond James.

There is no guarantee that these statements, opinions, or forecasts provided herein will prove to be correct. Past performance may not be indicative of future results.

Investing involves risk and you may incur a profit or loss regardless of strategy selected. International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility

Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor’s results will vary.

Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

Investments & Wealth Institute™ (The Institute) is the owner of the certification marks “CIMA” and “Certified Investment Management Analyst.” Use of CIMA and/or Certified Investment Management Analyst signifies that the user has successfully completed The Institute’s initial and ongoing credentialing requirements for investment management professionals.