The focus of the markets this week was on inflation.

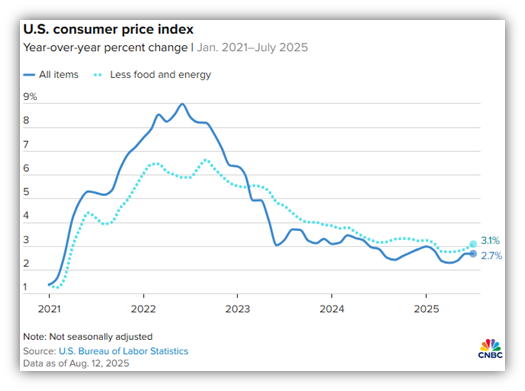

On Tuesday we received the inflation report for July and it showed the Consumer Price Index (CPI) rose a modest 0.2%, firmly in line with expectations and down from previous monthly readings. The inflation rate remained at 2.7%, better than the Dow Jones estimates that predicted the inflation rate would tick higher to 2.8%.

So, with a weakening job market and tame inflation, the Fed may have little choice but to cut interest rates in September.

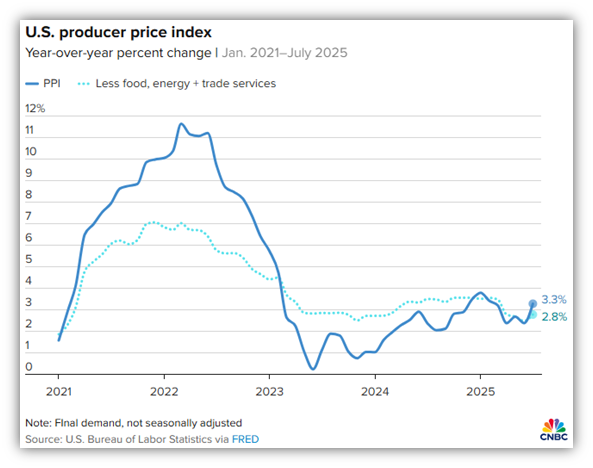

But wait, there’s more! We received more inflation data this week – the July Producers Price Index (PPI) was released on Thursday. Where the CPI reflects changes in prices paid by consumers, the PPI reflects changes in the prices paid by companies. It is often referred to as “wholesale inflation,” and it rose much higher than expected in July. Wholesale prices jumped 0.9%, compared with the Dow Jones estimate for a 0.2% gain. It was the biggest monthly increase since June 2022.

PPI is interesting because it can often show inflation in the pipeline that could be felt by consumers in the near future.

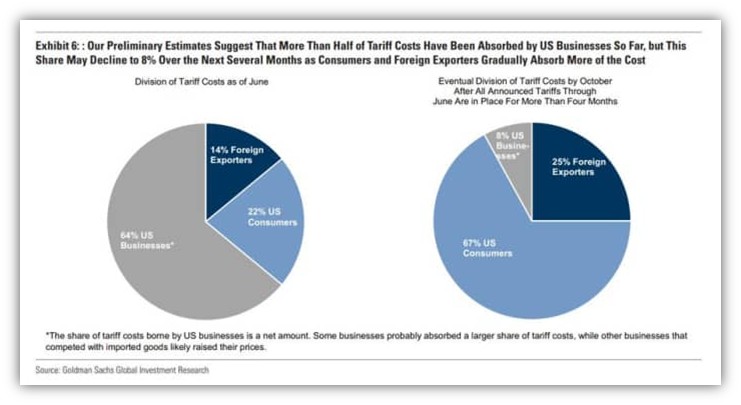

“The fact that PPI was stronger-than-expected and CPI has been relatively soft suggests that businesses are eating much of the tariff costs instead of passing them onto the consumer,” said Clark Geranen, chief market strategist at CalBay Investments. “Businesses may soon start to reverse course and start passing these costs to consumers.”

https://www.cnbc.com/2025/08/14/ppi-inflation-report-july-2025-.html

This is exactly what Goldman Sachs reported on Monday, before either of these inflation reports were released. Through June, they found that US businesses absorbed 64% of the tariff costs. Consumers took on 22% of the tariffs, while foreign exporters, by lowering their export prices, absorbed 14%.

In light of all this news, the S&P 500 reached a new all-time high this week. Markets are trusting US corporations can find ways to maintain their profit margins while absorbing these higher costs.

If absorbing these higher costs causes profits to stumble, stock prices will likely be due for a correction this fall.

Have a great weekend.

Jack C. Harmon II, CFP®, CIMA

Principal, Harmon Financial Advisors

Registered Principal, Raymond James Financial Services

Harmon Financial Advisors, Inc. is an independent, fee-based financial planning firm and an independent Registered Investment Advisor. Investment advisory services offered through Raymond James Financial Services Advisors, Inc. and Harmon Financial Advisors, Inc. Securities offered through Raymond James Financial Services, Inc. Member FINRA/SIPC. Harmon Financial Advisors, Inc. is not a registered broker/dealer and is independent of Raymond James Financial Services, Inc.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information in this commercial email has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Any opinions are those of Harmon Financial Advisors, Inc. and not necessarily those of RJFS or Raymond James.

There is no guarantee that these statements, opinions, or forecasts provided herein will prove to be correct. Past performance may not be indicative of future results.

Investing involves risk and you may incur a profit or loss regardless of strategy selected. International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility

Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor’s results will vary.

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market.

Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

Investments & Wealth Institute™ (The Institute) is the owner of the certification marks “CIMA” and “Certified Investment Management Analyst.” Use of CIMA and/or Certified Investment Management Analyst signifies that the user has successfully completed The Institute’s initial and ongoing credentialing requirements for investment management professionals.