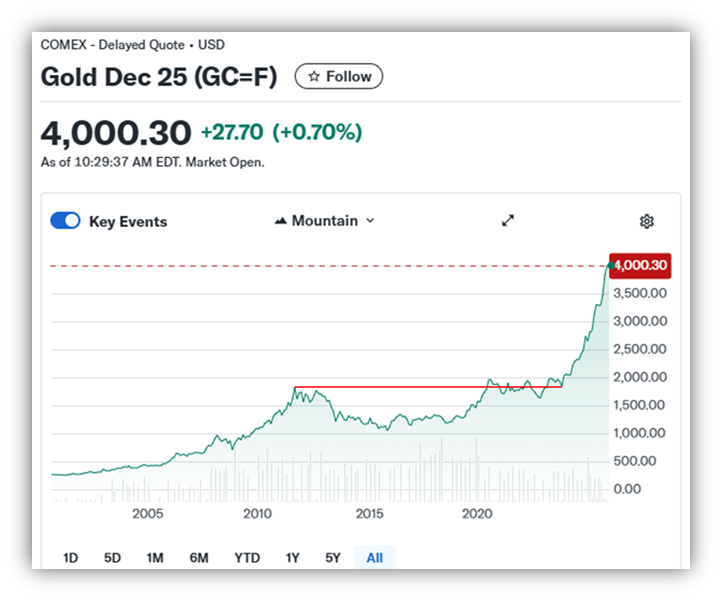

Major stock indices remain near all-time highs this week as the government shutdown continues. Also, gold crossed $4,000 per ounce for the first time this week, an increase of over 50% from its price at the beginning of the year. Gold can be a tricky investment for the long-term though. There have been long periods in history where the price of gold did not appreciate, such as 2011 – 2023 pictured below.

https://finance.yahoo.com/quote/GC=F/

Gold does not pay interest or dividends, and its price is not tied to profits like stocks. Like any other asset, its price fluctuates based upon supply and demand factors, but the drivers behind demand for gold are different than the factors driving demand for many other investments. Typically, investors have turned to gold during periods of economic uncertainty and high inflation, viewing it as both a safe haven when markets turn volatile and a hedge against rising prices.

However, the markets have not been very volatile this year and the inflation rate remains below 3%. This year demand for gold has risen for a couple of other reasons. First is de-dollarization. Globally, there has been an accelerated effort by many countries to reduce their ties to the US dollar since 2022.

“The gold rally started in 2022,” Giovanni Staunovo, commodity analyst at UBS Global Wealth Management, said via email on Tuesday. The “trigger point” for the increase was when the U.S. and other Western allies moved to freeze around $300 billion of Russian foreign holdings at the beginning of the war in Ukraine, he added.

Central banks in other nations are “the quiet force behind this climb,” deVere’s Green said. “They are buying close to one thousand [tons] of gold each year to reduce exposure to the dollar and to reinforce their financial resilience.

The US has fewer options to sanction a country when they become less dependent on our currency.

Another major driver behind the increased demand for gold is devaluation of the US dollar. The value of the US dollar against other currencies dropped about 11% in the first half of this year, the biggest decline in more than 50 years. According to Google’s AI –

A weak U.S. dollar is a consequence of factors like a widening fiscal deficit, expectations of the Federal Reserve cutting interest rates, and concerns about U.S. economic and political stability.

Further depreciation of the US dollar could have significant impacts for consumers, businesses, investors and ultimately for the overall economy: It would be more expensive for Americans to travel abroad, US assets could be less compelling for foreign investors, and import prices could rise, putting pressure on inflation. On the positive side, however, the weaker dollar could be a boost for American exporters.

Have a great weekend.

Jack C. Harmon II, CFP®, CIMA

Principal, Harmon Financial Advisors

Registered Principal, Raymond James Financial Services

Harmon Financial Advisors, Inc. is an independent, fee-based financial planning firm and an independent Registered Investment Advisor. Investment advisory services offered through Raymond James Financial Services Advisors, Inc. and Harmon Financial Advisors, Inc. Securities offered through Raymond James Financial Services, Inc. Member FINRA/SIPC. Harmon Financial Advisors, Inc. is not a registered broker/dealer and is independent of Raymond James Financial Services, Inc.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information in this commercial email has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Any opinions are those of Harmon Financial Advisors, Inc. and not necessarily those of RJFS or Raymond James.

There is no guarantee that these statements, opinions, or forecasts provided herein will prove to be correct. Past performance may not be indicative of future results.

Investing involves risk and you may incur a profit or loss regardless of strategy selected. International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility

Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor’s results will vary.

Bond prices and yields are subject to change based upon market conditions and availability. If bonds are sold prior to maturity, you may receive more or less than your initial investment. There is an inverse relationship between interest rate movements and fixed income prices. Generally, when interest rates rise, fixed income prices fall and when interest rates fall, fixed income prices rise.

Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

Investments & Wealth Institute™ (The Institute) is the owner of the certification marks “CIMA” and “Certified Investment Management Analyst.” Use of CIMA and/or Certified Investment Management Analyst signifies that the user has successfully completed The Institute’s initial and ongoing credentialing requirements for investment management professionals.