As of Friday morning, both stocks and bonds are wrapping up another positive month as we head into year-end and the holiday season.

The Fed met this week and cut interest rates another 0.25%, but comments from Fed Chair Powell made it clear that another rate cut at their next meeting in December was far from certain.

“In the committee’s discussions at this meeting, there were strongly differing views about how to proceed in December,” Powell said during his post-meeting news conference. “A further reduction in the policy rate at the December meeting is not a foregone conclusion. Far from it.”

https://www.cnbc.com/2025/10/29/fed-rate-decision-october-2025.html

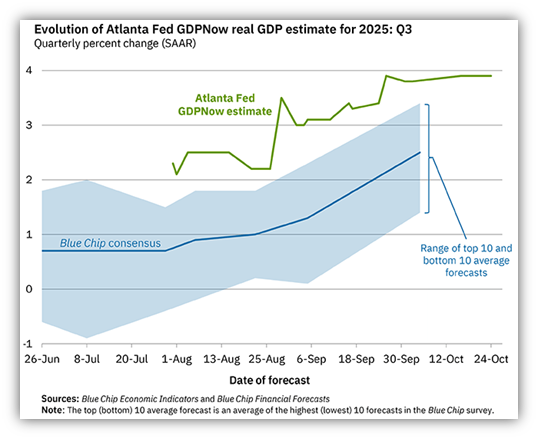

Markets welcomed the expected cut, but remain apprehensive about rate cuts going forward as they should be. It’s not even clear that the US economy needed another rate cut this week as the Atlanta Fed is expecting 3rd quarter economic growth to come in at an annual rate of 3.9%.

https://www.atlantafed.org/cqer/research/gdpnow.aspx

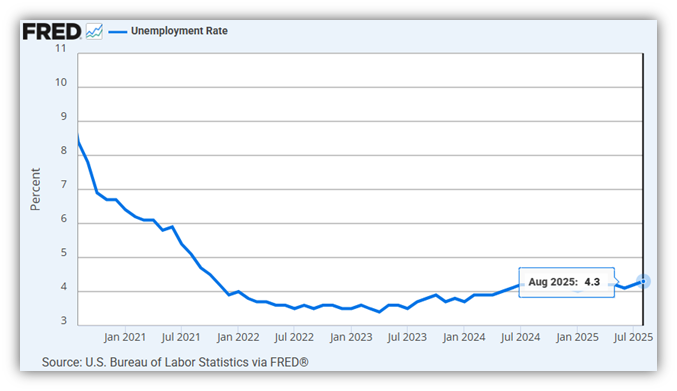

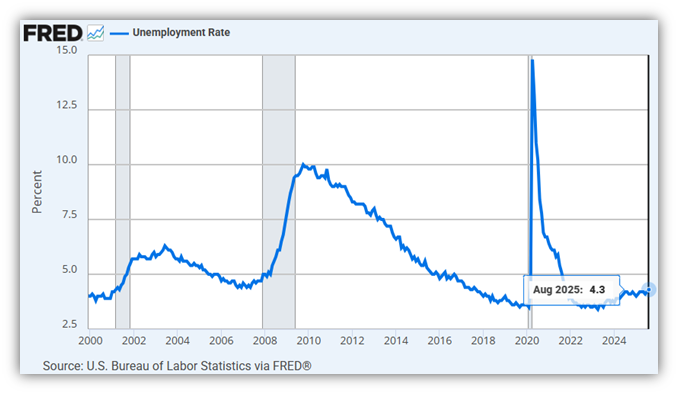

The Fed has been clear that their primary motivation behind the current round of interest rate cuts is to counter the weakening job market. The last reading we have for the unemployment rate is August since the government shutdown has indefinitely delayed the calculation and release of September data. And as this shutdown drags on, it may be quite a while before we see October data as well.

The unemployment rate has been slowly drifting higher since the historically low unemployment rate resulting from the massive Covid stimulus. However, unemployment still remains much lower than the average for the past couple of decades.

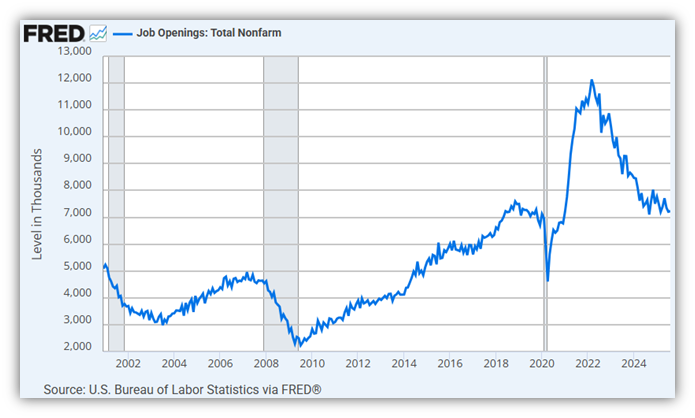

Over the past year, job openings have stabilized near pre-Covid levels.

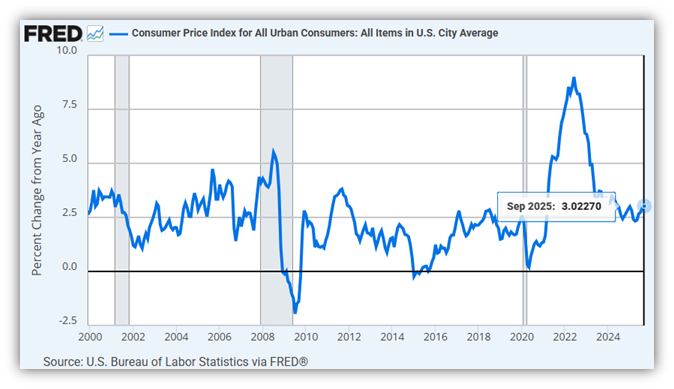

Interest rate cuts are meant to stimulate economic growth and, hopefully, hiring. But this can come at the risk of overheating the economy and driving up prices (inflation). The Fed has a target inflation rate of 2%, but we haven’t quite gotten there yet. We reached 2.3% in April, but the rate of inflation has risen to 3.0% as of September.

The markets are loving this. Economic growth near 4%, unemployment below 5%, inflation at 3%, PLUS interest rate cuts for more stimulus? It’s a recipe that is good for stocks, but could possibly make inflation a frontpage story for 2026.

Have a great weekend.

Jack C. Harmon II, CFP®, CIMA

Principal, Harmon Financial Advisors

Registered Principal, Raymond James Financial Services

Harmon Financial Advisors, Inc. is an independent, fee-based financial planning firm and an independent Registered Investment Advisor. Investment advisory services offered through Raymond James Financial Services Advisors, Inc. and Harmon Financial Advisors, Inc. Securities offered through Raymond James Financial Services, Inc. Member FINRA/SIPC. Harmon Financial Advisors, Inc. is not a registered broker/dealer and is independent of Raymond James Financial Services, Inc.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information in this commercial email has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Any opinions are those of Harmon Financial Advisors, Inc. and not necessarily those of RJFS or Raymond James.

There is no guarantee that these statements, opinions, or forecasts provided herein will prove to be correct. Past performance may not be indicative of future results.

Investing involves risk and you may incur a profit or loss regardless of strategy selected. International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility

Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor’s results will vary.

Bond prices and yields are subject to change based upon market conditions and availability. If bonds are sold prior to maturity, you may receive more or less than your initial investment. There is an inverse relationship between interest rate movements and fixed income prices. Generally, when interest rates rise, fixed income prices fall and when interest rates fall, fixed income prices rise.

Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

Investments & Wealth Institute™ (The Institute) is the owner of the certification marks “CIMA” and “Certified Investment Management Analyst.” Use of CIMA and/or Certified Investment Management Analyst signifies that the user has successfully completed The Institute’s initial and ongoing credentialing requirements for investment management professionals.