Markets have remained very resilient in the new year while facing a multitude of potential distractions, both domestically and abroad. Stock indices are hovering near their all-time highs, focusing on AI, earnings, and the economy.

While we won’t have any 4th quarter economic growth (GDP) reports until February 20, the US economy appears to be growing at a stronger pace than expected.

Atlanta Fed estimate: 5.3%

https://www.atlantafed.org/cqer/research/gdpnow

New York Fed estimate: 2.6% https://www.newyorkfed.org/research/policy/nowcast/#nowcast/2025:Q4

The Atlanta Fed’s estimate of 5.3% would be the strongest quarter of economic growth since the sharp rebound after covid, but we’ll have to see how their estimates evolve between now and February 20.

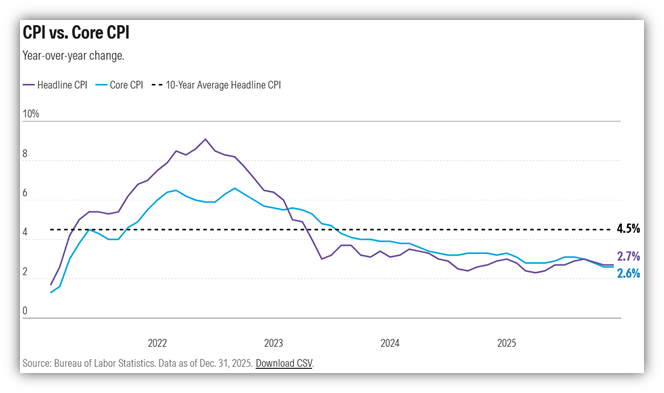

December inflation was 2.7%, tame and in line with expectations.

https://www.morningstar.com/economy/inflation-moderated-december-latest-cpi-report-shows

The unemployment rate fell from 4.5% to 4.4% in December with both job creation and layoffs lower than expected. Additionally, labor market changes related to AI and immigration are likely offsetting each other to some degree. Average hourly wages were up 3.8% in the past year, which was a little higher than expected.

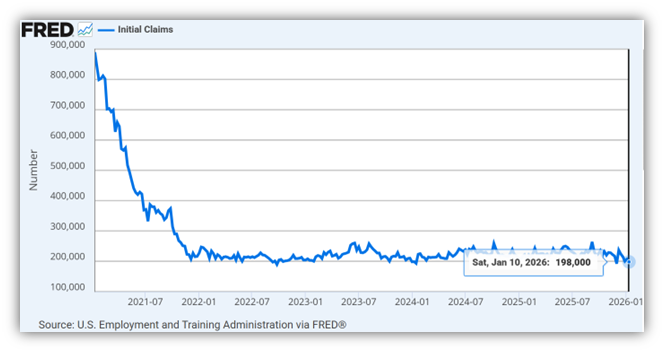

Weekly jobless claims are a near real-time indicator of the health of the job market. Claims fell by 9,000 from the previous week to 198,000 on the week ending January 10th, contrasting with market expectations of an increase to 215,000. This is the second-lowest reading in two years.

Given all this positive economic data – solid estimated GDP growth, tame inflation, and a stabilizing labor market – the odds of another interest rate cut from the Fed when they meet later this month have fallen to just 5%.

Have a great weekend.

Jack C. Harmon II, CFP®, CIMA

Principal, Harmon Financial Advisors

Registered Principal, Raymond James Financial Services

Harmon Financial Advisors, Inc. is an independent, fee-based financial planning firm and an independent Registered Investment Advisor. Investment advisory services offered through Raymond James Financial Services Advisors, Inc. and Harmon Financial Advisors, Inc. Securities offered through Raymond James Financial Services, Inc. Member FINRA/SIPC. Harmon Financial Advisors, Inc. is not a registered broker/dealer and is independent of Raymond James Financial Services, Inc.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information in this commercial email has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Any opinions are those of Harmon Financial Advisors, Inc. and not necessarily those of RJFS or Raymond James.

There is no guarantee that these statements, opinions, or forecasts provided herein will prove to be correct. Past performance may not be indicative of future results.

Investing involves risk and you may incur a profit or loss regardless of strategy selected. International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility

Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor’s results will vary.

Bond prices and yields are subject to change based upon market conditions and availability. If bonds are sold prior to maturity, you may receive more or less than your initial investment. There is an inverse relationship between interest rate movements and fixed income prices. Generally, when interest rates rise, fixed income prices fall and when interest rates fall, fixed income prices rise.

Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

Investments & Wealth Institute™ (The Institute) is the owner of the certification marks “CIMA” and “Certified Investment Management Analyst.” Use of CIMA and/or Certified Investment Management Analyst signifies that the user has successfully completed The Institute’s initial and ongoing credentialing requirements for investment management professionals.