I don’t think anyone’s head actually exploded, but there was a lot of information for markets to digest this week.

Coming into the week, US corporate earnings for the 2nd quarter have been better than expected.

“For Q2 2025 (with 34% of S&P 500 companies reporting actual results), 80% of S&P 500 companies have reported a positive EPS surprise and 80% of S&P 500 companies have reported a positive revenue surprise.”

https://www.factset.com/earningsinsight

However, it appears good earnings were already priced into the market and stock prices remain historically high. The forward 12-month P/E ratio for the S&P 500 is 22.4. This P/E ratio is above the 5-year average (19.9) and above the 10-year average (18.4).

The US economy grew at an annualized rate of 3.0 percent in the second quarter of 2025, according to the Bureau of Economic Analysis (BEA). This growth reversed a -0.5% decline in the first quarter. The increase was primarily driven by a decrease in imports and increased consumer spending.

President Trump’s August 1st deadline for tariffs has arrived and an “agreement” has been struck between the US and Europe.

Some are happy with the deal, but some are not. The BBC described it this way –

“Many across Europe breathed a sigh of relief that European negotiators had avoided 30% tariffs threatened by Trump months ago. Other countries are still racing to finalize deals with the US to avoid sweeping levies. Few European leaders rejoiced at the announcement that a 15% tariff would be applied on most EU exports to the US – an improvement on the 30% tariff initially threatened by Trump, but still a substantial hike from the former 4.8% average rate.”

https://www.bbc.com/news/articles/cvgp5q4x4nzo

Many non-European countries will still face tariff rates higher than 15%.

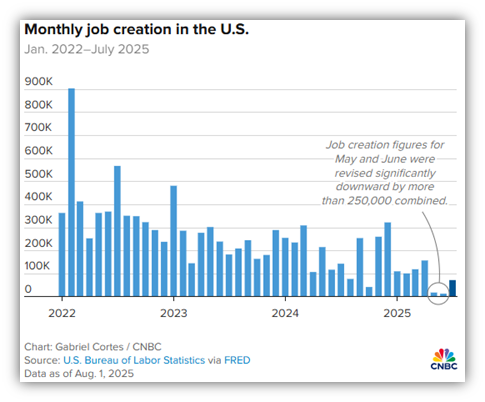

But the biggest news for the week was the July jobs report released Friday morning. The US economy created just 73,000 jobs versus forecasts of 100,000. While this was certainly unwelcomed news, the real surprises were the downward adjustments made to the previously-announced May and June numbers.

May job creation – previously stated: 125,000 updated: 19,000

June job creation – previously stated: 147,000 updated: 14,000

https://www.cnbc.com/2025/08/01/jobs-report-july-2025.html

The unemployment rate rose from 4.1% to 4.2% as predicted. While this report certainly shows a weakening job market, it is far from a WEAK job market with unemployment so low.

Why were the May and June numbers so far off? First of all, counting net new jobs is very difficult and has become even more so since COVID. Traditional employment has changed with the rise of the “gig economy” (the gig economy is a labor market characterized by short-term, temporary, or freelance jobs filled by independent contractors). But more recently, government cost-cutting measures has made it more difficult for the Bureau of Labor Statistics to be as accurate as they would like to be. I heard one economist describe it as a pilot flying a plane using only 2/3 of the instruments he previously had available.

The Fed met this week and left interest rates unchanged as expected.

I attended a reception this week for Jamie Dimon, CEO and Chairman of the Board for JP Morgan Chase, as he was visiting Atlanta. With all the positive and negative news swirling about recently, he was asked what his outlook was for the near-term. He responded with the question, “Have you ever ridden a wild bronco? Buckle up!” Then he said he was more positive than he was a few months ago, and that people consistently underestimate the resiliency of the US economy.

Have a great weekend.

Jack C. Harmon II, CFP®, CIMA

Principal, Harmon Financial Advisors

Registered Principal, Raymond James Financial Services

Harmon Financial Advisors, Inc. is an independent, fee-based financial planning firm and an independent Registered Investment Advisor. Investment advisory services offered through Raymond James Financial Services Advisors, Inc. and Harmon Financial Advisors, Inc. Securities offered through Raymond James Financial Services, Inc. Member FINRA/SIPC. Harmon Financial Advisors, Inc. is not a registered broker/dealer and is independent of Raymond James Financial Services, Inc.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information in this commercial email has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Any opinions are those of Harmon Financial Advisors, Inc. and not necessarily those of RJFS or Raymond James.

There is no guarantee that these statements, opinions, or forecasts provided herein will prove to be correct. Past performance may not be indicative of future results.

Investing involves risk and you may incur a profit or loss regardless of strategy selected. International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility

The Dow Jones Industrial Average (DJIA), commonly known as “The Dow” is an index representing 30 stocks of companies maintained and reviewed by the editors of the Wall Street Journal.

The MSCI World ex USA Index captures large and mid-cap companies across 22 of 23 Developed Markets (DM) countries excluding the United States. With 985 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor’s results will vary.

Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

Investments & Wealth Institute™ (The Institute) is the owner of the certification marks “CIMA” and “Certified Investment Management Analyst.” Use of CIMA and/or Certified Investment Management Analyst signifies that the user has successfully completed The Institute’s initial and ongoing credentialing requirements for investment management professionals.