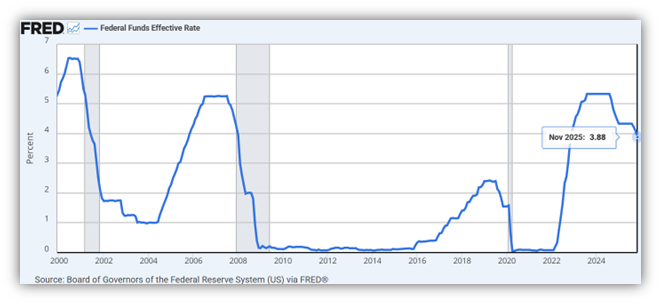

As expected, the Fed announced a 0.25% interest rate cut this week, bringing the Fed rate down to 3.88%.

Markets welcomed the news, with the US stock market setting new all-time highs on Thursday. However, as interest rate cuts have helped move stocks higher, they’ve also moved money market rates lower.

Source: Moody’s Analytics – https://www.economy.com/united-states/money-market-rate

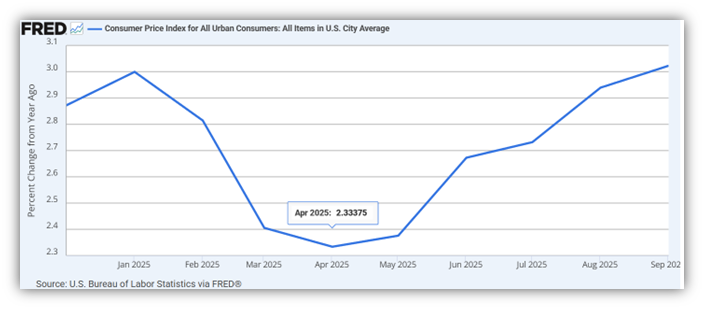

Money market rates averaged 4.34% in April when the inflation rate was 2.33%. That means money market was yielding a full 2% over inflation, or what’s referred to as a 2% “real return”.

Now, we have money market rates at 3.89% in November (before this week’s rate cut) and inflation running at 3.03% based on our most recent data. This gives us a real return for money market of 0.86% as interest rates have fallen and the inflation rate has risen. Given the current trajectories, it may become more difficult for savers to find safe havens in 2026 that can keep up with inflation.

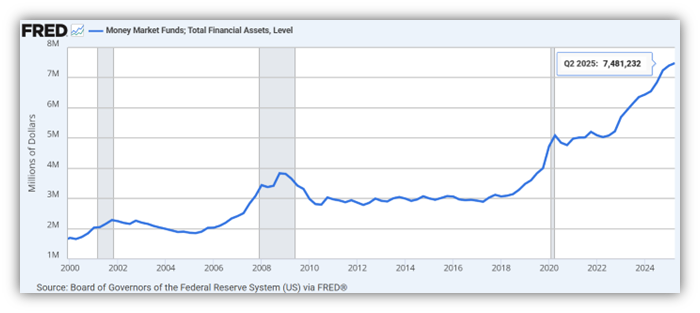

This comes at a time when money market deposits are at an all-time high of nearly $7.5 trillion.

Stock and bond investors are hoping the squeeze of real interest rates for CDs and money markets will bring some of these assets off the sidelines and into the markets. At a minimum, it could make these safe havens a little less attractive for new deposits and encourage investors to at least consider investing in bonds instead.

Have a great weekend.

Jack C. Harmon II, CFP®, CIMA

Principal, Harmon Financial Advisors

Registered Principal, Raymond James Financial Services

Harmon Financial Advisors, Inc. is an independent, fee-based financial planning firm and an independent Registered Investment Advisor. Investment advisory services offered through Raymond James Financial Services Advisors, Inc. and Harmon Financial Advisors, Inc. Securities offered through Raymond James Financial Services, Inc. Member FINRA/SIPC. Harmon Financial Advisors, Inc. is not a registered broker/dealer and is independent of Raymond James Financial Services, Inc.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information in this commercial email has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Any opinions are those of Harmon Financial Advisors, Inc. and not necessarily those of RJFS or Raymond James.

There is no guarantee that these statements, opinions, or forecasts provided herein will prove to be correct. Past performance may not be indicative of future results.

Investing involves risk and you may incur a profit or loss regardless of strategy selected. International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility

Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor’s results will vary.

Bond prices and yields are subject to change based upon market conditions and availability. If bonds are sold prior to maturity, you may receive more or less than your initial investment. There is an inverse relationship between interest rate movements and fixed income prices. Generally, when interest rates rise, fixed income prices fall and when interest rates fall, fixed income prices rise.

Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

Investments & Wealth Institute™ (The Institute) is the owner of the certification marks “CIMA” and “Certified Investment Management Analyst.” Use of CIMA and/or Certified Investment Management Analyst signifies that the user has successfully completed The Institute’s initial and ongoing credentialing requirements for investment management professionals.