Last week we pointed out that markets were down as robust economic numbers, specifically the December jobs report, were raising concerns that the economy was potentially too strong and inflation could possibly reaccelerate. However, this week we received the December inflation numbers and they were a bit better than expected so stocks have rallied this week. Wall Street hopes these good inflation numbers will make the Fed comfortable cutting interest rates 3 – 4 times this year without risking a resurgence of inflation.

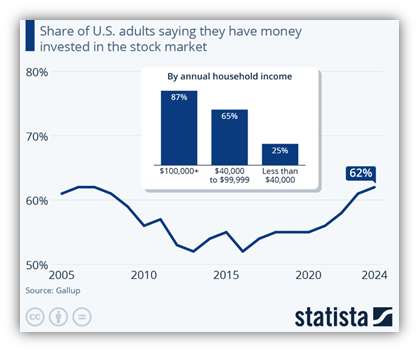

Although the economy may not NEED lower interest rates, there are a couple of reasons the Fed would consider rate cuts anyway. First, the stock market has become a huge part of the US economy and it affects a lot of households.

Surprises by the Fed could cause significant shocks to the stock market and negatively affect the economy. Right now, the market wants lower interest rates and if the Fed feels they can cut rates without risking higher inflation they probably will.

Additionally, lower interest rates ease the burden of borrowers and there is no greater borrower than the US government. By lowering short-term interest rates, the Fed can help the US government borrow at lower costs.

Have a great weekend.

Jack C. Harmon II, CFP®, CIMA

Principal, Harmon Financial Advisors

Registered Principal, Raymond James Financial Services

Harmon Financial Advisors, Inc. is an independent, fee-based financial planning firm and an independent Registered Investment Advisor. Investment advisory services offered through Raymond James Financial Services Advisors, Inc. and Harmon Financial Advisors, Inc. Securities offered through Raymond James Financial Services, Inc. Member FINRA/SIPC. Harmon Financial Advisors, Inc. is not a registered broker/dealer and is independent of Raymond James Financial Services, Inc.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information in this commercial email has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Any opinions are those of Harmon Financial Advisors, Inc. and not necessarily those of RJFS or Raymond James.

Investing involves risk and you may incur a profit or loss regardless of strategy selected.

The Dow Jones Industrial Average (DJIA), commonly known as “The Dow” is an index representing 30 stocks of companies maintained and reviewed by the editors of the Wall Street Journal.

Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, and CFP® in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

Investments & Wealth Institute™ (The Institute) is the owner of the certification marks “CIMA” and “Certified Investment Management Analyst.” Use of CIMA and/or Certified Investment Management Analyst signifies that the user has successfully completed The Institute’s initial and ongoing credentialing requirements for investment management professionals.