Happy New Year.

2025 finished as the third positive year in a row for major stock indices. The year for stocks can be summed up like this – a modestly positive start in the winter months followed by steep declines in the spring due to tariff concerns. Then, we spent the summer recovering from those declines, and in the fall, we saw stocks move ahead to all-time highs.

2026 began with the Trump administration capturing and detaining Venezuelan leader Nicholas Maduro. President Trump offered a $15 million bounty for Maduro’s arrest in his first term, then the Biden administration increased the bounty to $25 million, and finally the Trump administration raised it again to $50 million last year.

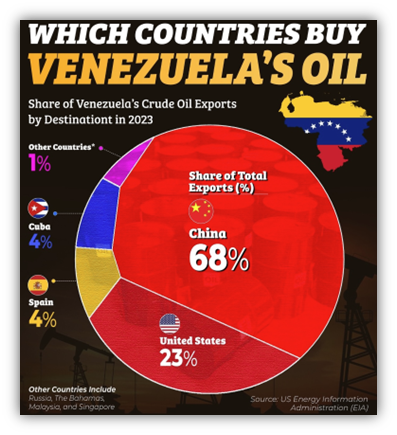

Equity and oil markets have remained relatively stable through the developments in Venezuela, partially because Venezuela exports much less oil than it previously did, with the vast majority of it going to China.

This has sent China looking to replace Venezuelan oil with oil from Russian, Iran, and Canada. However, not all oil is the same. Oil can be light or heavy, and it can be sour or sweet. This is important because refineries are typically set up to run most efficiently with a specific type of oil. Light oil is thinner and easier to transport, while heavy oil is thicker and often has added costs to move it, especially through pipelines. Sour oil has more sulfur content than sweet oil and is more corrosive.

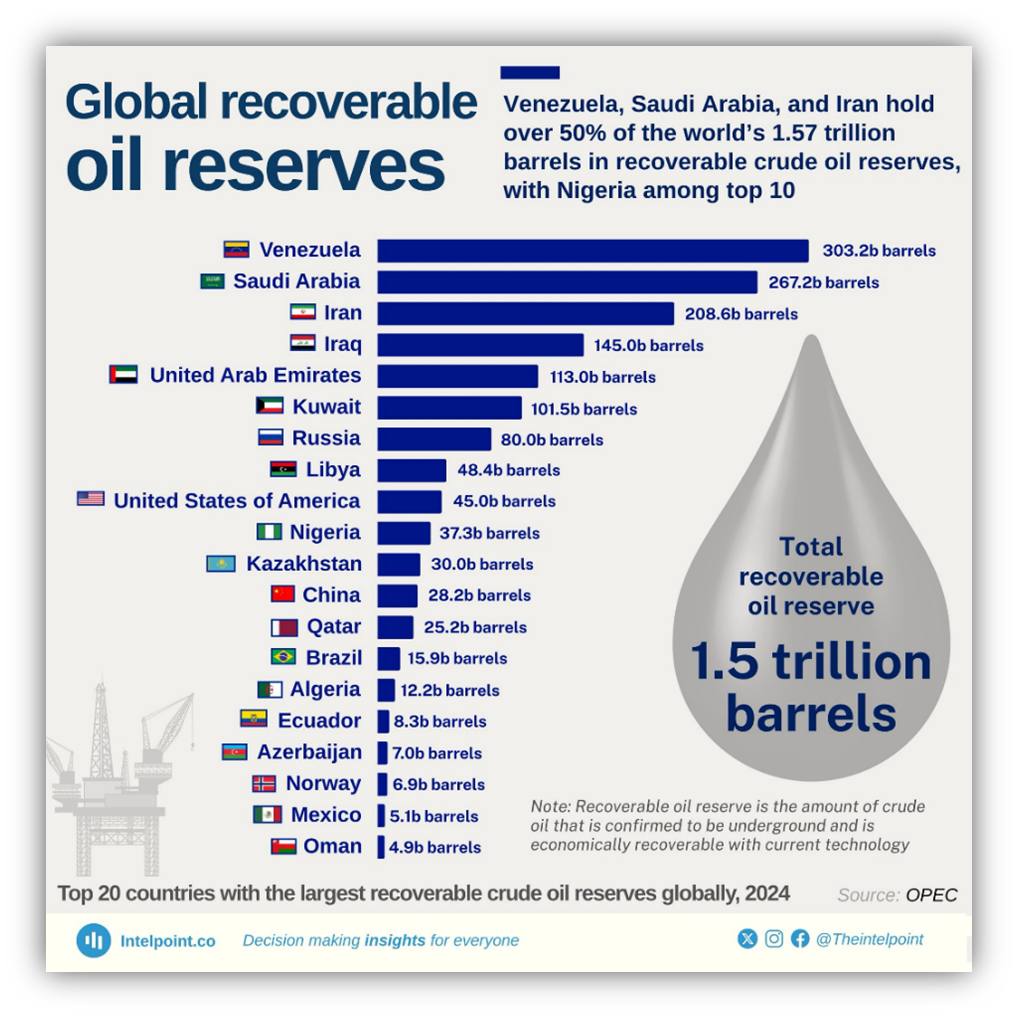

Note: OPEC chose not include Canada’s oil sands in this illustration

Venezuela has the largest recoverable oil reserves in the world and their oil is generally heavy and sour.

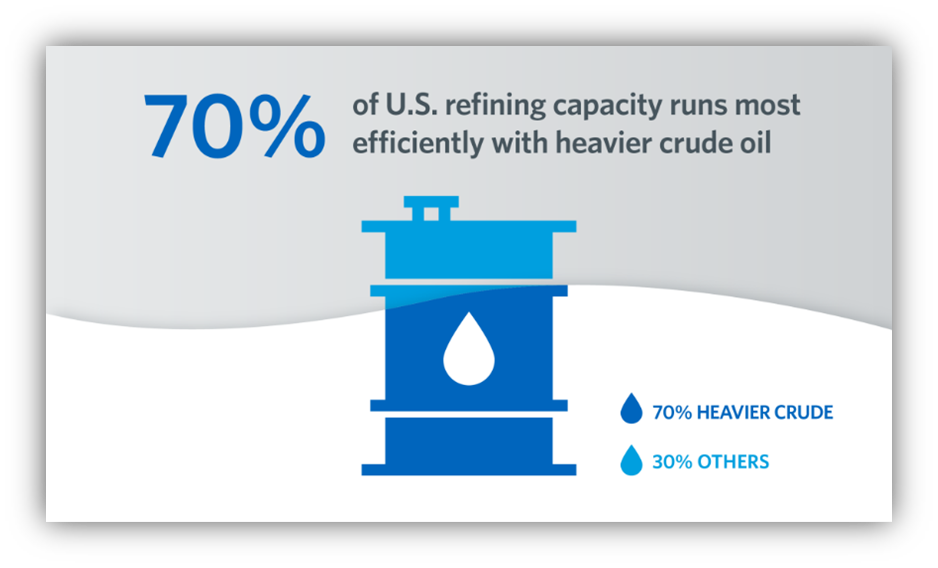

Guess what type of oil US gulf coast refineries are built to handle? According to Google AI –

“U.S. Gulf Coast refineries are built to process a diverse mix of crudes, but excel at handling heavy, sour (high-sulfur) oils like Venezuelan Maya and Mexican Maya.”

Gulf coast refineries are currently processing a lot of Canadian crude, also heavy and sour. However, it’s more expensive to get Canadian oil from Alberta to the gulf through pipelines and trains, versus Venezuelan crude by tanker.

So, it’s easy to see the US buying more Venezuelan oil and less Canadian oil IF the future relationship between the US and Venezuela is good. Additionally, China is looking to replace Venezuelan oil and they would ideally like to have a similar oil for refining, such as Canadian oil. Again, according to Google AI –

“The best replacements for Venezuelan heavy crude are primarily Canadian heavy oil, particularly Alberta’s oil sands crude (like Merey-grade alternatives), and also Middle Eastern crudes.”

While it would be more expensive for China to pay to move Canadian crude through pipelines to the coast, then by tanker to China, it may be their best option as Canada is likely a more stable source than Middle Eastern countries.

All said, this is likely just the beginning of a reconfiguration of the world’s energy markets.

Have a great weekend.

Jack C. Harmon II, CFP®, CIMA

Principal, Harmon Financial Advisors

Registered Principal, Raymond James Financial Services

Harmon Financial Advisors, Inc. is an independent, fee-based financial planning firm and an independent Registered Investment Advisor. Investment advisory services offered through Raymond James Financial Services Advisors, Inc. and Harmon Financial Advisors, Inc. Securities offered through Raymond James Financial Services, Inc. Member FINRA/SIPC. Harmon Financial Advisors, Inc. is not a registered broker/dealer and is independent of Raymond James Financial Services, Inc.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information in this commercial email has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Any opinions are those of Harmon Financial Advisors, Inc. and not necessarily those of RJFS or Raymond James.

There is no guarantee that these statements, opinions, or forecasts provided herein will prove to be correct. Past performance may not be indicative of future results.

Investing involves risk and you may incur a profit or loss regardless of strategy selected. International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility

Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor’s results will vary.

Bond prices and yields are subject to change based upon market conditions and availability. If bonds are sold prior to maturity, you may receive more or less than your initial investment. There is an inverse relationship between interest rate movements and fixed income prices. Generally, when interest rates rise, fixed income prices fall and when interest rates fall, fixed income prices rise.

Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

Investments & Wealth Institute™ (The Institute) is the owner of the certification marks “CIMA” and “Certified Investment Management Analyst.” Use of CIMA and/or Certified Investment Management Analyst signifies that the user has successfully completed The Institute’s initial and ongoing credentialing requirements for investment management professionals.