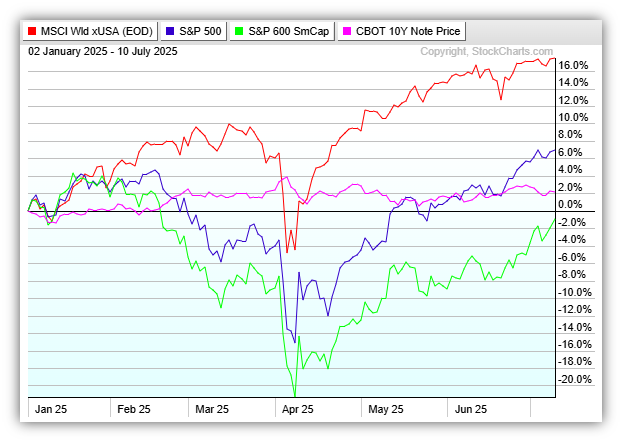

In the past few weeks, the S&P 500 (blue) surpassed its previous all-time high set in February and is now up approximately 7% year to date. However, US stocks remain far behind international indices (red) so far this year. US small company stocks (green) are still negative and bonds (pink) are slightly positive.

While the US markets remain jittery over threatened tariffs, stocks continue to climb on optimism the higher tariffs will never actually be implemented as deadlines continue to be extended. If President Trump were to follow through on some of these threats, markets could quickly dip lower to account for the uncertainty of outcomes.

The uncertainty around tariffs and trade policy is starting to be reflected in the capital market forecasts we use in our retirement planning and portfolio management. We like to stay abreast of the latest insights from some of the world’s largest money managers, including Vanguard and BlackRock.

For the first time ever, BlackRock is now publishing 2 sets of forecasts in an attempt to capture the widening range of potential outcomes in the markets.

https://www.blackrock.com/institutions/en-axj/insights/charts/capital-market-assumptions

The 1st set of forecasts are similar to their past forecasts, where they say, “we assume hard economic rules limit the pace at which the structure of the global capital market can change.” These forecasts haven’t changed much over the past few months:

US large-cap stocks 6.67% 10-year annualized expected return

Non-US large-cap stocks 8.64% 10-year annualized expected return

Their 2nd set of forecasts are new, and are referred to as their “alternative scenario”. I see these forecasts as a sort of worst-case scenario, but BlackRock describes them this way – “In our alternative scenario, the trade policy fallout is more severe, triggering a near-term contraction in U.S. activity, even weaker growth, and higher inflation. Investors demand even more risk premium for holding U.S. assets and U.S. term premium rises even further as foreign bondholders question the sustainability of U.S. debt.”

US large-cap stocks -0.28% 10-year annualized expected return

Non-US large-cap stocks 10.08% 10-year annualized expected return

As I said, I believe these types of forecasts are not very likely, but BlackRock’s decision to begin publishing them are indicative of the greater uncertainty that’s making planning and investing more difficult for both institutions and individual investors.

Have a great weekend.

Jack C. Harmon II, CFP®, CIMA

Principal, Harmon Financial Advisors

Registered Principal, Raymond James Financial Services

Harmon Financial Advisors, Inc. is an independent, fee-based financial planning firm and an independent Registered Investment Advisor. Investment advisory services offered through Raymond James Financial Services Advisors, Inc. and Harmon Financial Advisors, Inc. Securities offered through Raymond James Financial Services, Inc. Member FINRA/SIPC. Harmon Financial Advisors, Inc. is not a registered broker/dealer and is independent of Raymond James Financial Services, Inc.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information in this commercial email has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Any opinions are those of Harmon Financial Advisors, Inc. and not necessarily those of RJFS or Raymond James.

There is no guarantee that these statements, opinions, or forecasts provided herein will prove to be correct. Past performance may not be indicative of future results.

Investing involves risk and you may incur a profit or loss regardless of strategy selected. International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility

The MSCI ACWI ex USA Index captures large and mid-cap representation across 22 of 23 Developed Markets (DM) countries (excluding the US) and 24 Emerging Markets (EM) countries. With 1,983 constituents, the index covers approximately 85% of the global equity opportunity set outside the US.

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market.

The MSCI World ex USA Index captures large and mid-cap companies across 22 of 23 Developed Markets (DM) countries excluding the United States. With 985 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

The S&P SmallCap 600 seeks to measure the small-cap segment of the U.S. equity market. The index is designed to track companies that meet specific inclusion criteria to ensure that they are liquid and financially viable.

Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor’s results will vary.

Bond prices and yields are subject to change based upon market conditions and availability. If bonds are sold prior to maturity, you may receive more or less than your initial investment. There is an inverse relationship between interest rate movements and fixed income prices. Generally, when interest rates rise, fixed income prices fall and when interest rates fall, fixed income prices rise.

Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

Investments & Wealth Institute™ (The Institute) is the owner of the certification marks “CIMA” and “Certified Investment Management Analyst.” Use of CIMA and/or Certified Investment Management Analyst signifies that the user has successfully completed The Institute’s initial and ongoing credentialing requirements for investment management professionals.