The biggest market mover this week was the Trump administration’s announcement that a trade agreement had been reached with Japan regarding tariffs.

https://abcnews.go.com/Business/trumps-trade-agreement-japan/story?id=123991644

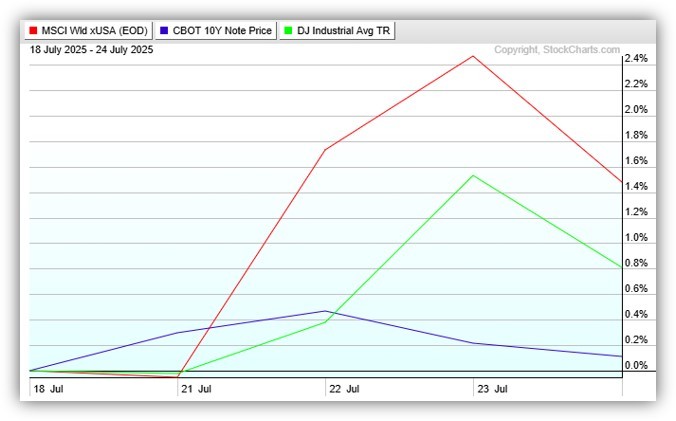

International stocks (red) spiked higher on the news, followed by US stocks (green) and bonds (blue).

Next week, all eyes will be on Europe as the August 1st deadline for a trade agreement looms. If a deal cannot be reached before then, a sweeping 30% tariff on European imports will go into effect. That would trigger a European response on August 7th, with increased tariffs targeting American imports like Harley-Davidson motorcycles, poultry, jeans, bourbon whiskey, chemicals, cars, aircraft, and aircraft parts.

Although US stock prices are expensive by many historic measures, investors still seem willing to push markets higher as we get more clarity on trade and tariffs.

Have a great weekend.

Jack C. Harmon II, CFP®, CIMA

Principal, Harmon Financial Advisors

Registered Principal, Raymond James Financial Services

Harmon Financial Advisors, Inc. is an independent, fee-based financial planning firm and an independent Registered Investment Advisor. Investment advisory services offered through Raymond James Financial Services Advisors, Inc. and Harmon Financial Advisors, Inc. Securities offered through Raymond James Financial Services, Inc. Member FINRA/SIPC. Harmon Financial Advisors, Inc. is not a registered broker/dealer and is independent of Raymond James Financial Services, Inc.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information in this commercial email has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Any opinions are those of Harmon Financial Advisors, Inc. and not necessarily those of RJFS or Raymond James.

There is no guarantee that these statements, opinions, or forecasts provided herein will prove to be correct. Past performance may not be indicative of future results.

Investing involves risk and you may incur a profit or loss regardless of strategy selected. International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility

The Dow Jones Industrial Average (DJIA), commonly known as “The Dow” is an index representing 30 stocks of companies maintained and reviewed by the editors of the Wall Street Journal.

The MSCI World ex USA Index captures large and mid-cap companies across 22 of 23 Developed Markets (DM) countries excluding the United States. With 985 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor’s results will vary.

Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

Investments & Wealth Institute™ (The Institute) is the owner of the certification marks “CIMA” and “Certified Investment Management Analyst.” Use of CIMA and/or Certified Investment Management Analyst signifies that the user has successfully completed The Institute’s initial and ongoing credentialing requirements for investment management professionals.