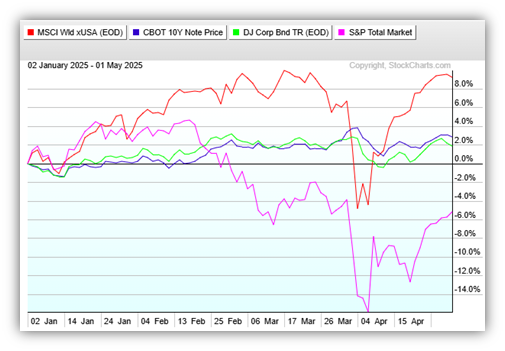

Stocks continued to rebound this week as international stocks (red) remain positive year-to-date while US stocks (pink) have made significant gains from their lows, but remain negative so far this year. US government bonds (blue) and corporate bonds (green) have behaved well this year and are positive.

Global markets were boosted this week on news that China is evaluating the possibility of trade talks with the US.

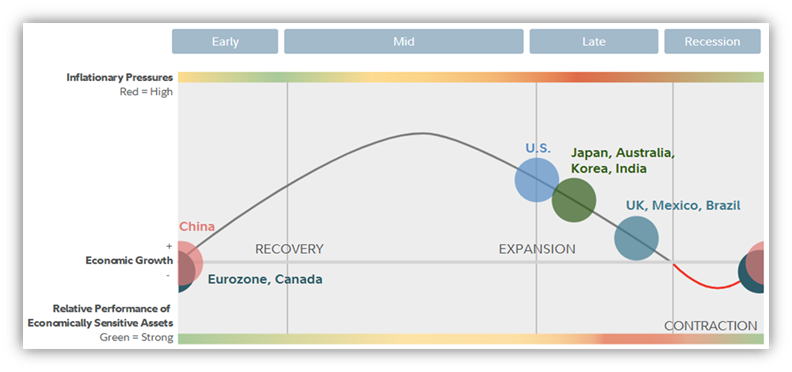

The Chinese economy is in the early stage of recovery and a trade war with the US is the last thing they need now.

Therefore, it’s no surprise to hear that the Chinese government is quietly exempting its retaliatory tariffs on some US goods in an effort to blunt the negative impact on their economy.

“It shows how, underneath its tough rhetoric, Beijing is trying to mitigate the impact of the U.S. trade war on its export-reliant economy, the world’s second-largest, which was already under pressure from a broader slowdown.” https://www.newsweek.com/china-quietly-exempts-key-us-goods-tariffs-report-2065950

In other good news this week we learned that the US job market remained stronger than expected in April, with 177,000 jobs created versus the Dow Jones estimate of 133,000.

https://www.cnbc.com/2025/05/02/jobs-report-april-2025.html

Finally, we got our first look at US economic growth (GDP) for the 1st quarter this week and it showed a -0.3% contraction. On the surface, this looks concerning. But when we look at the components of GDP the picture becomes much clearer. While it looks like US consumer spending (blue) and business investment (orange) were good, a massive spike in imports (brown) dragged GDP lower as Americans stocked up on foreign goods in anticipation of higher prices due to tariffs. Additionally, US government spending (gold) declined slightly in the 1st quarter, the first time since 2022.

Have a great weekend.

Jack C. Harmon II, CFP®, CIMA

Principal, Harmon Financial Advisors

Registered Principal, Raymond James Financial Services

Harmon Financial Advisors, Inc. is an independent, fee-based financial planning firm and an independent Registered Investment Advisor. Investment advisory services offered through Raymond James Financial Services Advisors, Inc. and Harmon Financial Advisors, Inc. Securities offered through Raymond James Financial Services, Inc. Member FINRA/SIPC. Harmon Financial Advisors, Inc. is not a registered broker/dealer and is independent of Raymond James Financial Services, Inc.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information in this commercial email has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Any opinions are those of Harmon Financial Advisors, Inc. and not necessarily those of RJFS or Raymond James.

There is no guarantee that these statements, opinions, or forecasts provided herein will prove to be correct. Past performance may not be indicative of future results.

Investing involves risk and you may incur a profit or loss regardless of strategy selected.

The S&P Total Market Index (TMI) is designed to track the broad equity market, including large-, mid-, small-, and micro-cap stocks.

The MSCI World ex USA Index captures large and mid-cap companies across 22 of 23 Developed Markets (DM) countries excluding the United States. With 985 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

The Dow Jones Corporate Bond Index is an equally weighted basket of 96 recently issued investment-grade corporate bonds with laddered maturities. The index intends to measure the return of readily tradable, high-grade U.S. corporate bonds. It is priced daily.

Bond prices and yields are subject to change based upon market conditions and availability. If bonds are sold prior to maturity, you may receive more or less than your initial investment. There is an inverse relationship between interest rate movements and fixed income prices. Generally, when interest rates rise, fixed income prices fall and when interest rates fall, fixed income prices rise.

Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, and CFP® in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

Investments & Wealth Institute™ (The Institute) is the owner of the certification marks “CIMA” and “Certified Investment Management Analyst.” Use of CIMA and/or Certified Investment Management Analyst signifies that the user has successfully completed The Institute’s initial and ongoing credentialing requirements for investment management professionals.