Major US stock and bond indices were lower this week over US budget deficit concerns earlier in the week, and renewed tariff worries on Friday.

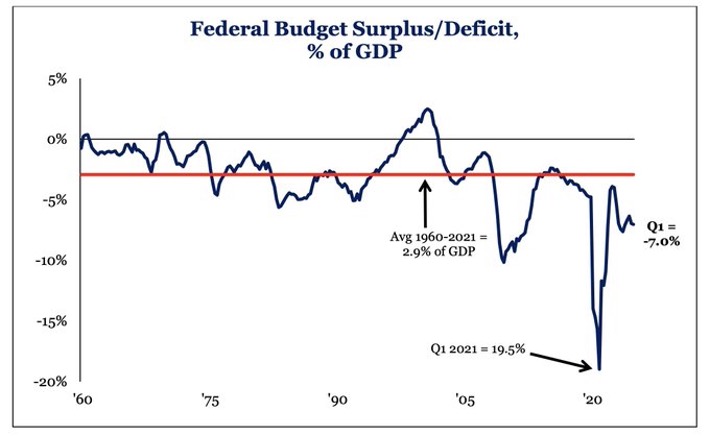

We’ve written before about the need for the federal government to change course from expanding budget deficits back towards the long-term average of 3%. Deficit spending exploded during Covid, which was normal and expected. And while the deficit made it back to pre-Covid levels, it never returned to a sustainable level before growing again.

Sources: Federal Reserve Bank of St. Louis; U.S. Office of Management and Budget via FRED®

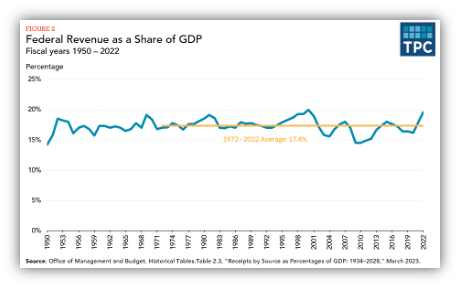

The deficit is a simple formula. It’s government revenues (primarily taxes) minus spending. It’s easy to see where the problem lies when we consider that revenues remain near their 50-year average as the deficit is growing.

Through periods of higher tax rates and lower tax rates, government revenues have bounced up and down between 15% and 20% of GDP, averaging 17.4%. We have a spending problem and the spending bill passed by the House of Representatives this week was seen by the markets as another move in the wrong direction. Moody’s downgraded the US government’s credit rating, interest rates spiked higher, and investors sold both stocks and bonds.

“Moody’s didn’t tell us anything we didn’t already know, but they did underscore that things aren’t going in the right direction,” said Kathy Jones, chief fixed income strategist at Charles Schwab. “The ‘big, beautiful bill’ also, when it comes to debt and deficits, is not going in the right direction.”

However, problems at home have created opportunities abroad as international stocks are slightly higher this week and far ahead of US stocks year-to-date.

Emerging markets stocks are in the spotlight again as the “sell U.S.” narrative gained fresh momentum, following Moody’s recent downgrade of the U.S. credit rating.

https://www.cnbc.com/2025/05/22/emerging-markets-next-bull-market-sell-us-market-watchers.html

US bonds found some support Friday as renewed discussions of higher tariffs on the EU sparked investors to sell US stocks and buy bonds.

Through this year’s “dynamic” environment, the US stock market remains remarkably resilient, barely lower year-to-date. Earnings for US companies were surprisingly good in the 1st quarter and investors are hoping profits can remain solid. At this point our tactical risk model remains moderately conservative, recommending the majority of assets invested in cash and bonds with the remainder in foreign stocks for now.

Have a wonderful Memorial Day weekend.

Jack C. Harmon II, CFP®, CIMA

Principal, Harmon Financial Advisors

Registered Principal, Raymond James Financial Services

Harmon Financial Advisors, Inc. is an independent, fee-based financial planning firm and an independent Registered Investment Advisor. Investment advisory services offered through Raymond James Financial Services Advisors, Inc. and Harmon Financial Advisors, Inc. Securities offered through Raymond James Financial Services, Inc. Member FINRA/SIPC. Harmon Financial Advisors, Inc. is not a registered broker/dealer and is independent of Raymond James Financial Services, Inc.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information in this commercial email has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Any opinions are those of Harmon Financial Advisors, Inc. and not necessarily those of RJFS or Raymond James.

There is no guarantee that these statements, opinions, or forecasts provided herein will prove to be correct. Past performance may not be indicative of future results.

Investing involves risk and you may incur a profit or loss regardless of strategy selected.

Bond prices and yields are subject to change based upon market conditions and availability. If bonds are sold prior to maturity, you may receive more or less than your initial investment. There is an inverse relationship between interest rate movements and fixed income prices. Generally, when interest rates rise, fixed income prices fall and when interest rates fall, fixed income prices rise.

Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, and CFP® in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

Investments & Wealth Institute™ (The Institute) is the owner of the certification marks “CIMA” and “Certified Investment Management Analyst.” Use of CIMA and/or Certified Investment Management Analyst signifies that the user has successfully completed The Institute’s initial and ongoing credentialing requirements for investment management professionals.