Stocks are shrugging off concerns over the US government shutdown that began this week. This can continue as long as the shutdown doesn’t last too long, but after a couple of weeks investors may become nervous. Markets are essentially “flying blind” with regards to the direction of the economy since we no longer have the regular economic reports that are typically developed and released by the government. We were supposed to receive the September unemployment report today, but that’s not happening. The September inflation report is scheduled to be published on October 15th, but we’ll have to wait and see.

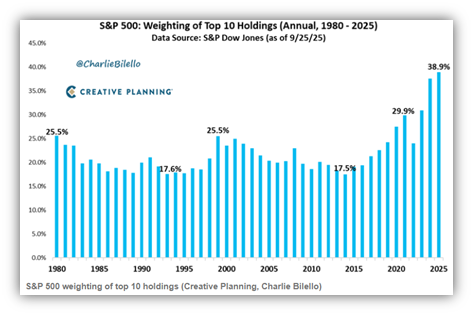

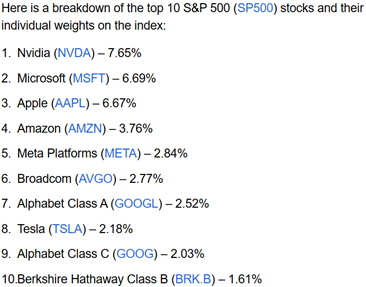

While momentum in the US stock market is carrying it higher, market indices are becoming extremely concentrated in just a handful of companies. Concentration risk is now at an all-time high, with just 10 stocks making up almost 40% of the S&P 500.

This is certainly not meant to endorse or discourage investment in these stocks. Instead, it’s important to note that the behavior of major US equity indices going forward will be heavily influenced by fluctuations in the stock prices of these companies.

9 of the top 10 companies listed above are technology companies, and investment in artificial intelligence (AI) has been the primary driver pushing their stock prices higher. A lot of money has rushed into AI, and it’s becoming clearer that AI has the potential to create tremendous change. But when it comes to investing, will we see a sufficient return on investment quickly enough to justify the sudden massive investment? No one can argue that the internet changed the world and created enormous wealth, but it took longer than many investors were willing to wait, leading to a 50% decline in the S&P 500 and a 78% decline in the Nasdaq from 2000 to 2002.

I’m not saying that we’re in a bubble, but how this AI boom plays out will depend on how quickly it can show real benefits and how long investors are willing to wait. While history doesn’t necessarily repeat itself, Goldman Sach CEO David Solomon recently warned that there are some similarities to the “dotcom bubble”.

“You’re going to see a similar phenomenon here,” he said. “I wouldn’t be surprised if in the next 12 to 24 months, we see a drawdown with respect to equity markets … I think that there will be a lot of capital that’s deployed that will turn out to not deliver returns, and when that happens, people won’t feel good.”

No one has a crystal ball, but it appears a lot of investors may be overlooking these risks in the market. It’s a good time to be diversified.

Have a great weekend.

Jack C. Harmon II, CFP®, CIMA

Principal, Harmon Financial Advisors

Registered Principal, Raymond James Financial Services

Harmon Financial Advisors, Inc. is an independent, fee-based financial planning firm and an independent Registered Investment Advisor. Investment advisory services offered through Raymond James Financial Services Advisors, Inc. and Harmon Financial Advisors, Inc. Securities offered through Raymond James Financial Services, Inc. Member FINRA/SIPC. Harmon Financial Advisors, Inc. is not a registered broker/dealer and is independent of Raymond James Financial Services, Inc.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information in this commercial email has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Any opinions are those of Harmon Financial Advisors, Inc. and not necessarily those of RJFS or Raymond James.

There is no guarantee that these statements, opinions, or forecasts provided herein will prove to be correct. Past performance may not be indicative of future results.

Investing involves risk and you may incur a profit or loss regardless of strategy selected. International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility

Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor’s results will vary.

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market.

The Nasdaq Composite Index is a market capitalization-weighted index of more than 2,500 stocks listed on the Nasdaq stock exchange. It is a broad index that is heavily weighted toward the important technology sector.

Bond prices and yields are subject to change based upon market conditions and availability. If bonds are sold prior to maturity, you may receive more or less than your initial investment. There is an inverse relationship between interest rate movements and fixed income prices. Generally, when interest rates rise, fixed income prices fall and when interest rates fall, fixed income prices rise.

Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

Investments & Wealth Institute™ (The Institute) is the owner of the certification marks “CIMA” and “Certified Investment Management Analyst.” Use of CIMA and/or Certified Investment Management Analyst signifies that the user has successfully completed The Institute’s initial and ongoing credentialing requirements for investment management professionals.